Cross-border demand means boat brokers need better digital marketing

Over the last few years the recreational boating industry has been facing a shifting landscape. For boat dealers and brokers, this means having a solid digital marketing strategy has never been more important, writes Kate Hurley, customer excellence director at the Boats Group. There are key considerations to ensure successful marketing and sales in an evolving boating and yachting market.

As buyer demand wanes and supply continues to grow, boats no longer sell themselves. With continued market normalisation following the boom experienced in the pandemic, consumer demand fell again in 2023, dipping by 10 per cent compared to 2022.

Meanwhile, there were 28 per cent more boats for sale online in the first quarter of 2024, compared to the same period in 2023. That’s according Boats Group’ data and means boat sellers need to adopt innovative, effective, and efficient marketing approaches to better capture buyer market share.

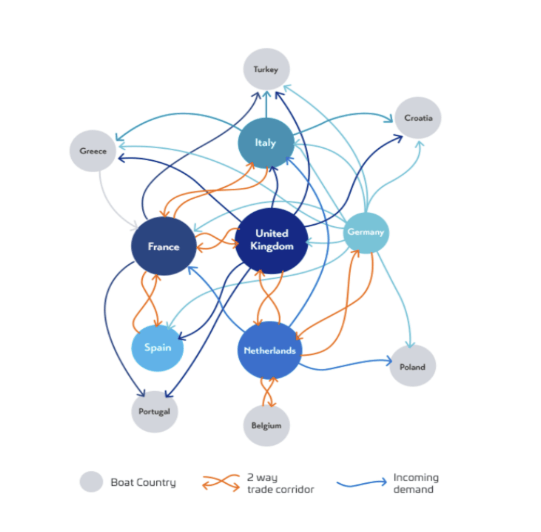

47 per cent of all boating demand in Europe is cross-border

The market for recreational boats has expanded beyond local borders in an increasingly interconnected world. Today’s buyers are no longer only looking for their dream boats in their own countries; they are looking globally, necessitating a comprehensive international marketing strategy.

Within Europe, looking for buyers cross-border has become a crucial marketing factor for brokers and dealers. According to a 2023 research study from Boats Group, 47 per cent of all boating demand in Europe is cross-border.

The study also reveals that certain boat-classes experience exceptionally high levels of cross-border demand, with some segments reaching up to 80 per cent. This trend is particularly noticeable in sailing multihulls, sailing cruisers, and motor yachts, which benefit from the highest levels of cross-border demand.

The price of a boat plays a significant role in determining the extent of foreign demand.

Higher-priced boats tend to attract more international interest; for instance, boats valued over $1 million see up to 80 per cent of their demand coming from foreign buyers, while for boats with a value of $10-25k, just under 20 per cent of demand is cross-border.

This means sellers of high-value boats should prioritise targeting international markets to reach a broader potential buyer audience and maximise their sales opportunities.

The study also shows that a boat’s location significantly influences cross-border demand patterns. Buyers based in Northern European countries, where local supply is often insufficient to meet the relatively high demand, are looking beyond their borders to find their next dream boat.

Netherlands and Germany, cross-border boat trade corridor works both ways

These buyers frequently turn to markets in Southern European countries such as France, Spain, and Italy – where buyers from the UK represent over 35 per cent of cross-border demand, while German buyers and Dutch buyers represent 25 and 17 per cent respectively. What’s also worth noting is that for the Netherlands and Germany, the cross-border trade corridor works both ways, forming one of the strongest in Europe.

However, the trend is reversed for Southern Europeans like Greeks, Croatians and Portuguese. Boats located in these countries receive high international demand, while local buyers don’t tend to look beyond their borders to purchase their boats. This regional dynamic underscores the importance for European sellers to consider cross-border marketing strategies to optimise their sales efforts.

High cost of leads from boat shows compared to digital channels

But how do brokers and dealers reach buyers in international markets without completely maxing out their marketing budgets? Considering the cost-per lead (CPL) across online and offline sales channels – a valuable metric for modern marketers – can help make more informed decisions about where a marketing and advertising budget should be invested.

Maximising marketing ROI and maintaining an efficient CPL is especially crucial during uncertain retail market conditions. Traditional channels like boat shows and print advertising, while offering broad reach and exposure to international buyers, often incur a very high CPL in the range of $600-$800.

When looking at the CPL for digital channels such as search engine marketing or online marketplaces, it becomes clear that they offer a demonstrably more efficient solution.

With a significantly lower CPL of under $100, online marketplaces, such as those forming the Boats Group network (with a targeted audience exceeding 18 million global boat buyers each month delivering over 100,000 high-quality leads) – are a much more cost-effective way to generate leads.

Online marketplaces for selling boats globally

In this new global landscape, online marketplaces are thriving, and Boats Group remains a trusted partner for success for thousands of boat dealers and brokers globally. Boats Group platforms saw an 11 per cent increase in unique visitors in 2023 – despite declining consumer demand – reaching more than 150 million yearly boat buyers. This positive trend in consistent quality traffic has continued into 2024, with 15 per cent growth in leads generated for boat sellers globally in Q1.

Recognising the evolving buyer journey, Boats Group has invested heavily in prioritising user experience, implementing streamlined search functionalities, modernised boat detail pages, and enhanced mobile apps for Boat Trader and YachtWorld, contributing to a seamless user experience and translating to a more engaged buyer base and increased conversion rates for sellers.

In today’s dynamic boating market, effective digital marketing strategies are paramount for boat dealers and brokers to stay ahead. Recognising the evolving buyer journey, adopting a strategic global perspective, and investing in efficient digital marketing channels such as online marketplaces are crucial steps. By leveraging these approaches, sellers can better connect with global buyers, maximise sales, and maintain the flexibility required to thrive as market dynamics continue to evolve.

(Kate Hurley is customer excellence director at Boats Group, which operates the world’s largest online boating marketplaces, including brands like Boat Trader and YachtWorld. For nearly three decades, Boats Group has helped marine retailers sell their products. Data sources: Google Analytics, Boats Group and soldboats.com data.)

Main image courtesy of BrooksElliott.

The post Cross-border demand means boat brokers need better digital marketing appeared first on Marine Industry News.